How to raise from dev tool, data, and infrastructure investors

Because raising capital can be challenging coming out of a niche

TLDR: European founders in developer tools, data, and software infrastructure often struggle to find the right investors. To address this, First Momentum Ventures has compiled a list of 53 investors from 42 funds focused on European startups, providing a valuable resource to help founders connect with suitable VCs. The list, which is constantly evolving, highlights investors' roles, typical investment sizes, and geographic focus.

At First Momentum Ventures, one of our key investment areas are developer tools, data and software infrastructure and we frequently notice that European founders in those domains lack knowledge about which investor might be a great fit for them.

So we made a list with folks from the European Venture Capital ecosystem that focus have a similar taste in very technical software topics to create more visibility for European founders.

The list is an evolving document, but currently contains 53 investors from 42 funds. All these funds are focused on European startups.

Below you can check out some aggregated analysis from the list:

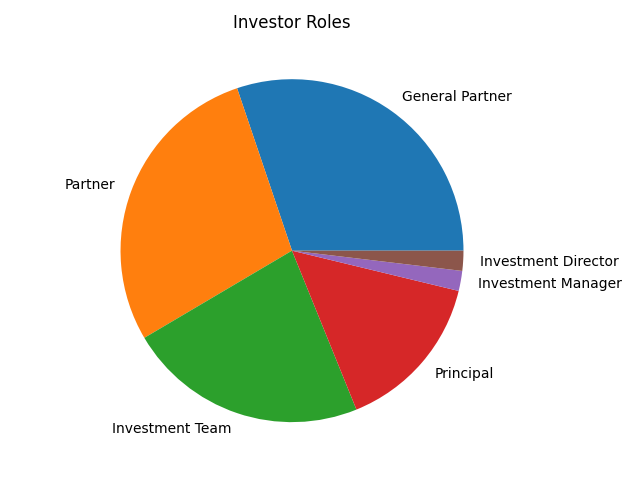

The majority of the investors on the list are partners or general partners. Other people on the list are principles or members from the fund’s investment team.

First Momentum Ventures is a pre-seed fund — it explicitly only funds startups that have never raised VC money before. Other funds also cover Seed rounds or Series A, and some funds even cover everything from pre-seed to Series A.

The ticket sizes vary with the stage at which the funds invest: most Pre-Seed & Seed investors commit between one and five million Euros. However, there are only a few European Series A funds in the list that can write large checks up to 20 million.

A little more than half of the funds on the list are based in Germany. About a third is based in the United Kingdom; the rest is based in France, Switzerland, or outside Europe. It is worth noting that there are likely more investors around Europe with an angle on dev, data, and infra which will be added over time.

Feel free to consult the list, and to share it among fellow investors and founders. If you would like to be added to the list, please contact us at david.meiborg@firstmomentum.vc.

Happy deal-making!

More exciting tech news

A startup is using AI to search for new materials needed for climate technologies. Cusp AI has just secured a $30 million seed round and plans to hire a lot of AI talent to grow and build its product. It is the latest in a growing wave of startups that are trying to tackle climate change with cutting-edge techniques.

For all the trendspotters out there: Venture firm Redpoint has published a list of 100 companies that are having a transformative impact on cloud infrastructure. The list includes industry behemoths like Databricks, Anthropic, and Stripe, but also several mid- and earlystage startups.

Are photonic chips the future? A number of startups are trying to resolve the technical difficulties that make optical chips — which use photon for information transmission — a reality. Today’s electron chips work well but are hard to make even smaller and faster because many transistors are already at atomic sizes. Photonic chips still face many challenges, but if the remaining technical challenges can be resolved, the upsides might be huge.